At its core, a loan is a promise of repayment. The critical question is how to evaluate the trust assumptions underlying that promise—whether it is collateral, reputation, or legal contracts.

In this article, I explore the fundamental nature of debt, examine how to price the trust assumptions underpinning it, and chart the future of lending infrastructure.

What Is Debt?

Before Money Existed, There Was Debt

Five thousand years ago, humans in small communities managed obligations to one another through relationships and reputation alone.

Initially, these debts were tracked simply by remembering who owed what to whom. As societies grew larger and more complex, this informal system of social memory became inadequate when people no longer knew each other personally. To address this challenge, communities developed formal debt-tracking systems. Among the earliest examples were the clay tablets of ancient Mesopotamia, where cuneiform script recorded debts, interest rates, and payment terms.

This management of obligations and trust formed the foundation of human global cooperation, emerging millennia before the invention of money itself.

Databases & Markets for Trust

Remarkably, we still manage debts much as we did 5,000 years ago with Mesopotamian clay tablets. Whether tracking state bonds, corporate loans, or positions on the Morpho protocol, we use databases to record who owes what and to whom.

For a given loan, one could have:

A key advantage of debt records is transferability between parties who trust the underlying repayment commitment.

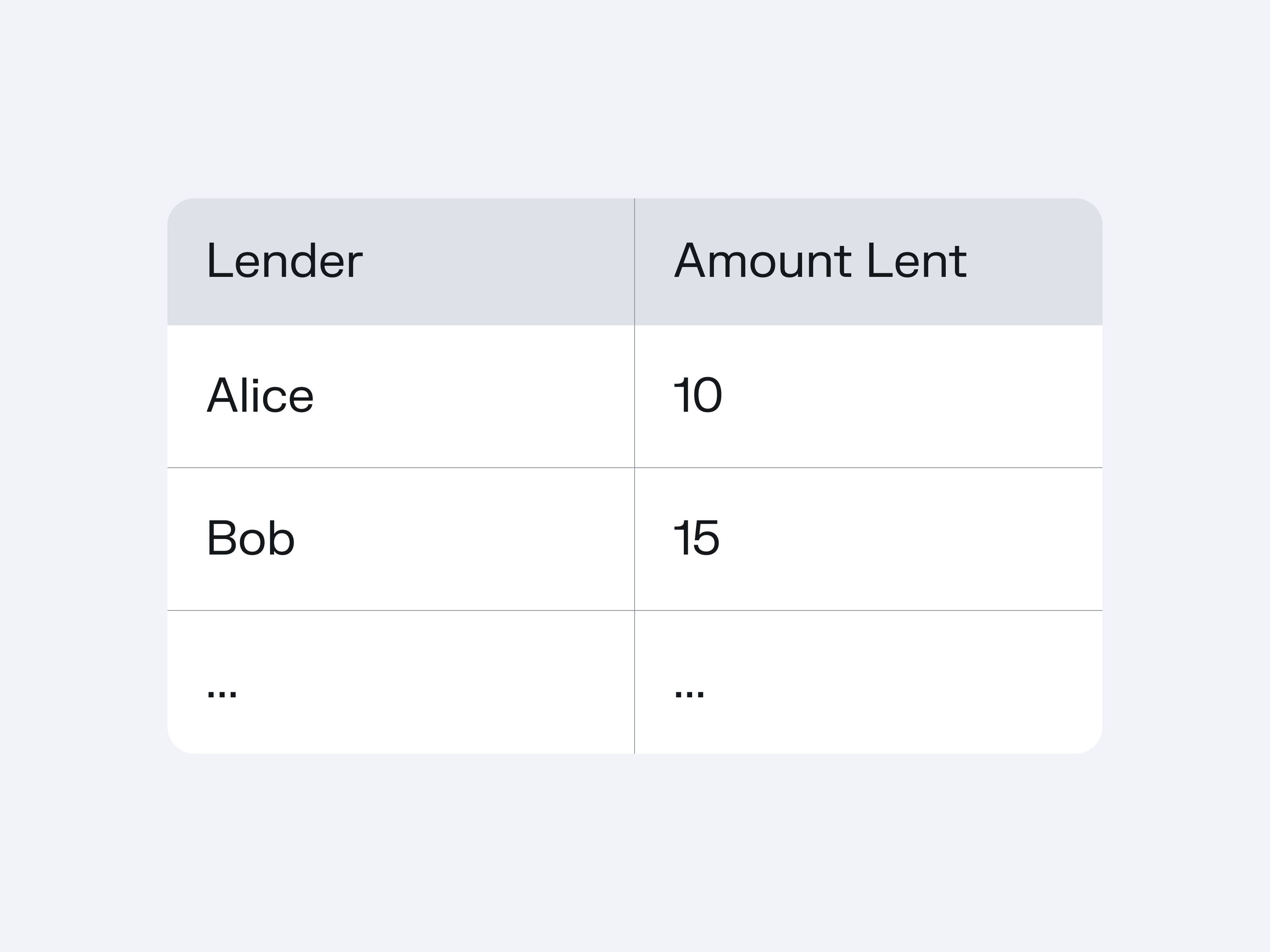

For example, if I lost my wallet and needed $1 for a croissant, I could write on paper, "I promise to repay you next week, trust me bro." and sign it and try to sell this obligation to someone to borrow funds. It’s unlikely a stranger ever buys this, but my cofounder, Merlin, probably would. The database entry would look like:

If Merlin needs his $1 back before I can repay, he could find another lender to replace him, effectively selling my signed piece of paper. Instead of repaying Merlin, I'd repay whoever purchased the obligation. Importantly, Merlin only needs to find someone who trusts me, even if they don't trust him. He might approach a family member to transfer the debt:

As people trade this written commitment, we just created a mini-market pricing the trust in my ability to repay.

Trust Assumptions

"Trust me bro"—the simple promise made without any legal or onchain contract—rarely extends beyond personal relationships. This is why most loans rely on stronger trust assumptions. Borrowers can make various commitments to build confidence from more lenders and secure better rates. For example, a borrower might demonstrate:

-

They are a verified human with a credit score of X that will be negatively impacted if I don't repay.

-

They have collateral A, it will be seized onchain at a certain price (enforced by Morpho’s Ethereum contract).

-

They have collateral B, it will be seized offchain at a certain price (enforced by a legal contract under the laws of France)

-

…

Yet, while all these guarantees and credentials can help maximize the borrower’s chances of receiving favorable terms from strangers, the earlier croissant example reveals a fundamental truth: trust is the only must-have for lending.

Although collateral, contracts, and credentials help enhance trust, they aren't prerequisites. All you need for a loan is a lender who trusts a borrower to some degree, and this degree reflects the loan's price through its interest rate.

Once understood, it reframes how we should think about lending infrastructures. Rather than obsessing over precise liquidation mechanics to secure loans, the real unlock lies in building markets to price trust efficiently in all its forms.

How to Price Trust Efficiently?

Create Open and Competitive Markets

When individuals seek a home loan in France, they typically approach just a single local bank for quotes. For corporate loans, companies usually engage only a handful of investment banks to underwrite their bonds, which are then quickly resold to a limited pool of institutional investors like credit funds. In onchain lending, the process follows a similar pattern—borrowers must accept whatever interest rate is set by the lending pool's governance or formula.

In each scenario, lenders and borrowers fail to conduct a truly competitive process across all potential counterparties, inevitably leading to suboptimal pricing and terms.

To achieve maximum efficiency, all loan intents should be broadcast openly, enabling universal discoverability and competitive bidding that delivers the best possible terms for all participants.

Enable Expression of Trust Assumptions

To price trust assumptions, participants first need to be able to articulate, code, and express them formally.

Borrowers should have clear ways to communicate trust assumptions that support their ability to repay, while lenders must be able to specify which trust assumptions they're willing to accept.

This is accomplished through:

-

Creating standardized formats for various types of trust, including economic (e.g., liquidatable collateral), legal (e.g., enforceable contracts), and reputational (e.g., verified credit scores).

-

Enabling these trust assumptions to be precisely communicated between parties.

-

Allow diverse loans to be priced as a function of standardized trust assumptions.

Minimize Infrastructure Trust Impact

The infrastructure should solely facilitate and execute lending agreements without introducing settlement risk or altering trust dynamics.

Cryptography, formal verification, immutable code deployed on a decentralized blockchain, ... are technologies that should help guarantee issuance, settlement, interest accounting, liquidation, … without introducing more trust assumptions.

Embracing the Free Market

A Price for Any Loan

I’m frequently asked “Onchain collateralized lending is great, but will we ever see under-collateralized lending in DeFi?”. After years of thinking about this problem, I believe the distinction is mostly artificial.

Loans should not be defined by the collateral they have, but by trust in the promise to repay. Providing onchain-liquidatable collateral is one factor that increases trust, but as discussed, it's just one among many, including reputation, legal contracts, and more.

Lending infrastructure should allow all active participants to price any trust assumptions:

-

When a borrower provides crypto collateral with liquidation guarantees, the market should price it.

-

When a borrower commits their house as collateral under French law, the market should price it.

-

When a reputable individual says, “trust me bro", even this should have a market-determined price.

When we build systems that efficiently price these diverse assumptions, the artificial boundary between collateralized and undercollateralized lending dissolves, revealing a unified framework for all lending markets.

For years, we believed that lending protocols should not issue a loan if liquidations cannot be enforced. But it shouldn’t be the protocol's decision whether a loan is issued; that’s for the market to decide.

The Future of Morpho

Morpho will fully embrace this vision of a free market for pricing borrowers' trustworthiness.

As a facilitator of trust, Morpho will enable all types of lenders and borrowers to connect. Starting by covering the full spectrum of crypto-collateralized loans, Morpho will be uniquely positioned to expand well beyond the current boundaries of onchain lending markets.

We will introduce some of these innovations in an upcoming article.